Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

We all know the grass is not always greener on the other side, but if you need to check out the real estate and possibly make a move, CEO Capital Strategies has the expertise, experience and a complete understanding of the issues.

It goes without saying, that leaving your current home is a very stressful venture and no one wants to move again, especially in an environment of significant regulatory change where there is increased pressure to justify your value proposition to your clients and the public.

Our many years of experience heading up Dealers who are active recruiters combined with our experience running Advisor financial planning practices, provides a highly qualified resource for Advisors. Seeking a potential new Dealer partner who is more closely aligned with the Advisor's vision is paramount and requires a high level of due diligence.

Dave Velanoff has over 47 years of experience in the Canadian financial services industry. With more than 30 years of leading notable public and privately held companies and divisions, Mr. Velanoff has been an integral part of a number of major financial companies' successes.

Additionally, having intimate familiarity with MFDA, IIROC, ICPM, MGA, Tax Services, Mortgage and Deposit Brokerage platforms, he brings extensive knowledge and value to every level of management. Mr. Velanoff also brings the experience of having participated in several company acquisitions, been President and/or President & CEO of 3 significant financial planning firms, a mortgage broker, life insurance MGA and deposit brokerage operations. He has served as a Director on a public company Financial Services Board, two private company Boards and three not for profit Boards.

Dave Velanoff authored the Retirement Succession Plan for one of Canada’s largest and most successful fully integrated Independent Financial firms which was eventually sold to one of Canada’s top five Banks.

Soon after being appointed CEO at MGIF he implemented a succession program that became one of the major value propositions and strategic initiatives of the company. After the successful sale of MGIF to one of Canada’s major financial institutions, Mr. Velanoff semi-retired and soon after created a business plan and vision to build a consolidator salaried financial planning firm. He aligned himself with key founding shareholder partners and together they built and restructured their company under the CEO Model methodology; a system designed to crystallize and magnify the value of an organization or corporation for future sale. In 2020 the business was sold to a strategic Investment Management firm for one of the highest multiples in their sector of the financial services industry.

Kristen Velanoff brings over 15 years of experience in the financial services industry specializing in process documentation, marketing facilitation, project management and strategic support.

Kristen worked for two significant financial corporations for 11 years in head office and branch environments. She has experience working with MFDA/IIROC (CIRO), ICPM, Life Insurance and non-financial organizations.

She is a graduate of the University of Waterloo with an Honours BA in Speech Communication, Retirement Pensions Associate (RPA) 1, Dalhousie University, Project Management, McMaster University, Panel Presenter, National Communications Association (NCA) and the Canadian Investment Funds Course (CIFC), IFSE Institute.

Steve Talosi Jr. has over 48 years of experience in the Canadian private business sector. For the past 37 years, he has operated a very successful financial planning practice assisting individuals and families plan and achieve financial success.

A graduate of the University of Waterloo's Co-op Bachelor of Math/Computer Science program with a minor in Business Administration, Steve began his career with IBM Canada in Toronto. He then relocated back to the Niagara Peninsula and held various management positions with Canadian Tire Financial Services managing Computer Operations, Office Services, Accounting and Personnel He then transferred those skill sets into establishing and managing his own financial planning practice.

Additionally, he served as the COO of one his former Mutual Fund Dealers. Responsible for all back-office operations and field relations, under Steve's management his Dealer was ranked #1 in Canada. He also served on the Field Advisory Committee for over 10 years for one of his other former Mutual Dealers. This committee served as the voice of the field force and a sounding board to Senior Management. From past experiences, Steve brings to the table a very comprehensive knowledge of the financial planning business from both a branch office and head office perspective.

In 2013, he pioneered the process of digitizing his financial planning office files including all historical files dating back to 1987. Creating a paperless office afforded Steve the opportunity to manage a much more efficient operation at less cost.

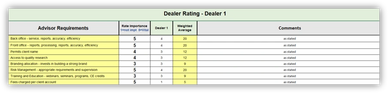

The Advisor completes this report on each prospective Dealer based on information from the due diligence process.

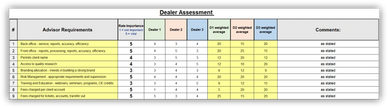

The results are imported into Report B (Dealer Assessment) for comparative purposes.

This report imports data from Report A (Dealer Rating) and consolidates the results to show the best alternatives for the Advisor.

Full report includes over 30 requirements.

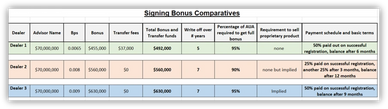

This report will compare signing bonuses and conditions offered by prospective Dealers.

Copyright © 2026 CEO Capital Strategies Inc. - All Rights Reserved.